Setting up a family budget system is certainly not exciting. But as painstaking as the process may seem, having a family budget system can help you understand and assess your family’s relationship with money.

Did you know that less than 50 percent of Canadians have a budget? Around 20 percent of those with a budget utilize a budget or savings mobile app to manage that budget.

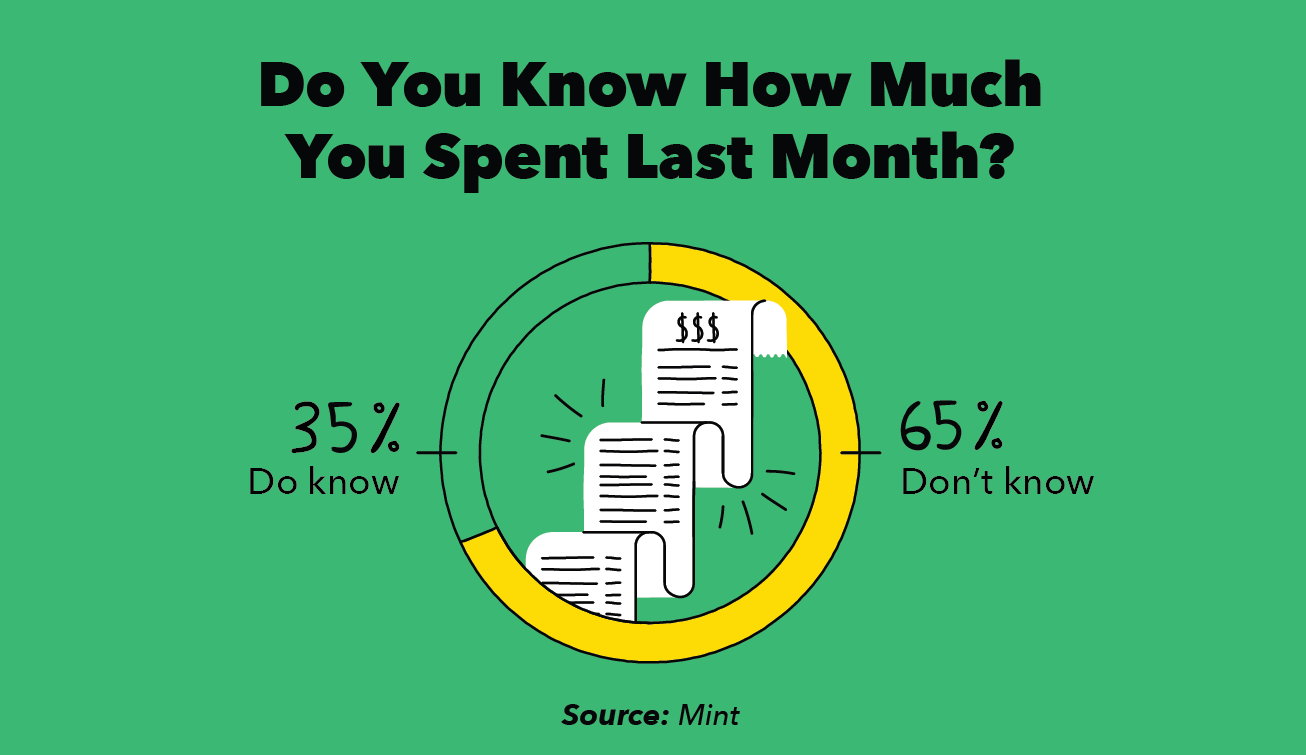

And roughly 65 percent of U.S. consumers don’t know how much they spend monthly, according to Intuit.

Budgeting systems do work. They also let you and your family track spending closely. Money management has never been as important than it is today. Putting a family budget system in place can have an impact on the family’s future financial wellness.

To help, we compiled a few top tips to choose the right budget system for family savings power. Let’s dive right in to budgeting!

It Begins With A Family Spending Audit

The first step in choosing the right family budget system is to get a clear picture of the family’s spending habits. This is where a spending audit comes in handy.

A financial family assessment may highlight spending that can be redirected toward savings, like takeout dinners and overpriced memberships.

Once you know where you stand, you can put a family budget system in place. For instance, the 50/30/20 budget system. This gives you and your family an outline for saving more money.

The two below family budget systems may be worth researching more:

The 50/30/20 Family Budget System

The 50/30/20 budget system outlines 50 percent of income going toward necessary expenses (mortgage, rent, insurance, utilities, etc.), 30 percent toward wants, and 20 percent toward savings.

This budgeting system can also be modified to increase saving potential. For example, if you dedicate less of your family’s monthly income to “wants” you can save more money. It could look more like a 50/20/30 family budget.

NerdWallet has a great 50/30/20 budget calculator tool worth looking into in order to jump start your family’s new budgeting system.

The Envelope Family Budget System

Another way to get your new family budget system moving in the right direction is to employ the envelope budget system. This is a simple, yet strict approach, to ensure your family budget stays on track, giving you more savings power.

How does the envelope family budget system work exactly? This budget system is a cash-based approach that allows you and your family to set spending limits per each category.

With your spending audit complete, you will know the exact categories you need to set up envelopes for. The envelope budget system may look like this:

- Homeowner expenses (mortgage, utilities, repairs, etc.)

- Grocery expenses (monthly spending limit for food)

- Kiddo’s expenses (school supplies, books, sports, clubs, entertainment, etc.)

- Vehicle expenses (car insurance, gas, repairs, etc.)

- Family entertainment (takeout, movies, weekend getaways, etc.)

- Emergency fund (set amount every month to save for family financial emergencies)

- Savings (set monthly amount based on other categories, etc.)

With the envelope budgeting system, you have a set amount of money for each category. This keeps spending under control, as long as you follow the plan and not dip into savings each month.

Choose A family Budget System That Works For Your Family

Not all budget systems are created equal. Some may be more time consuming and challenging than what they are actually worth.

To ensure you and your family have saving success with a great budget system, you need to ensure the right fit and flexibility for your family’s unique needs.

For example, using an Excel spreadsheet and/or zero-based budget may cause more confusion and eat up too much time. To keep budgeting simple and easy for every family member, leveraging technology to budget may be best.

Why not take advantage of the digital tools available? Budget apps for mobile devices are definitely worth checking out.

You can even use budgeting for the family as a teaching moment for your kiddos. You can have your ideal budgeting app while the kids have their own, like the Treasure Card app and prepaid debit card for kids and teens.

How much time do I have weekly to dedicate to budget tracking? Can a budget app streamline the process? These are good questions to ask. Ensure success when you begin a budget system by using a budgeting system that works for your family.

Choosing The Right Budget System For Family Savings Power

If you live within your means, a budgeting system may not be the best choice, since it may take too much time and resources to manage.

However, spending within one’s means is always challenging in today’s online shopping space. There are new and exciting products and services around every digital corner.

Setting up a family budget may be what the financial doctor ordered for your family, helping you and your loved ones save more money long-term.

Get a clear picture of what your spending looks like and take it from there. You will know quickly how a budget can be powerful for family financial wellness.