Money saving apps can certainly help you and your family reach financial saving goals. And money saving apps makes saving a whole lot easier.

Did you know that the average Canadian has around $1,000 in savings? That is definitely not enough to cover a major car repair or urgent house repair.

Want to save more money every month? Want to get your savings account above $10,000? A money saving app could do the trick.

To help, we compiled the top money saving apps in Canada and the U.S. for 2021. From setting money saving goals to saving bonuses, let’s take a deeper look.

Top Money Saving Apps For Canada Residents

Money Saving App #1: Wealthsimple

Wealthsimple is more than just an investment app and online wealth manager. This money saving app also has features that can take your saving goals to the next level.

For instance, Wealthsimple Roundup automates your spare change savings by investing or saving the money with little thought on your part.

This makes the process of saving much easier. You can also open a Wealthsimple Cash account, allowing you to save money with one of the best saving rates in Canada.

Money Saving App #2: Koho

Koho is another money saving app powerhouse for Canada residents. This app is also not your ordinary money management app.

This savings app for Canadians boasts features like budgeting, automatic savings, and cashback. Users alo get a free Visa card that is reloadable, attached to the app in Canada.

With the prepaid Visa card, you can earn cash back on purchases. You can also set up savings goals that can be tethered to the Roundup feature of the Koho app.

There is also the PowerUps feature, giving users the ability to hit those savings goals by getting between 0.50 to 2 percent cash back on every dollar spent with the prepaid card.

Money Saving App #3: Moka

The next top money saving app for Canada residents is Moka. Moka uses the spare change and investment model to help users in Canada save money easier.

The best part about this savings app is that you can continue healthy spending habits and save more money every month.

Moka is very similar to Acorns, a money saving app for U.S. residents (see #5 below). How does it work? If you spend $2.65 on a coffee, Moka will round up to $3.00 and invest the change.

The investments are automatic with a personalized portfolio of low-cost ETFs, helping you save and potentially make money through investments made on your behalf.

For only $3 per month, you can start using the Moka app to reach your savings goals in 2021. There is also a referral program for lovers of the app to recommend it to friends and family.

Top Money Saving Apps for U.S. Residents

Money Saving App #4: Digit

Digit is a savings app that is all about simplicity. The app can calculate just how much you can save each month based on your current spending habits.

Once it has the dollar amount, the app can automatically transfer the money to your savings account. Digit offers a 30-day free trial with paid upgrade membership.

One of the best features of this money saving app is the 0.10 percent annual saving bonus you will get every three months.

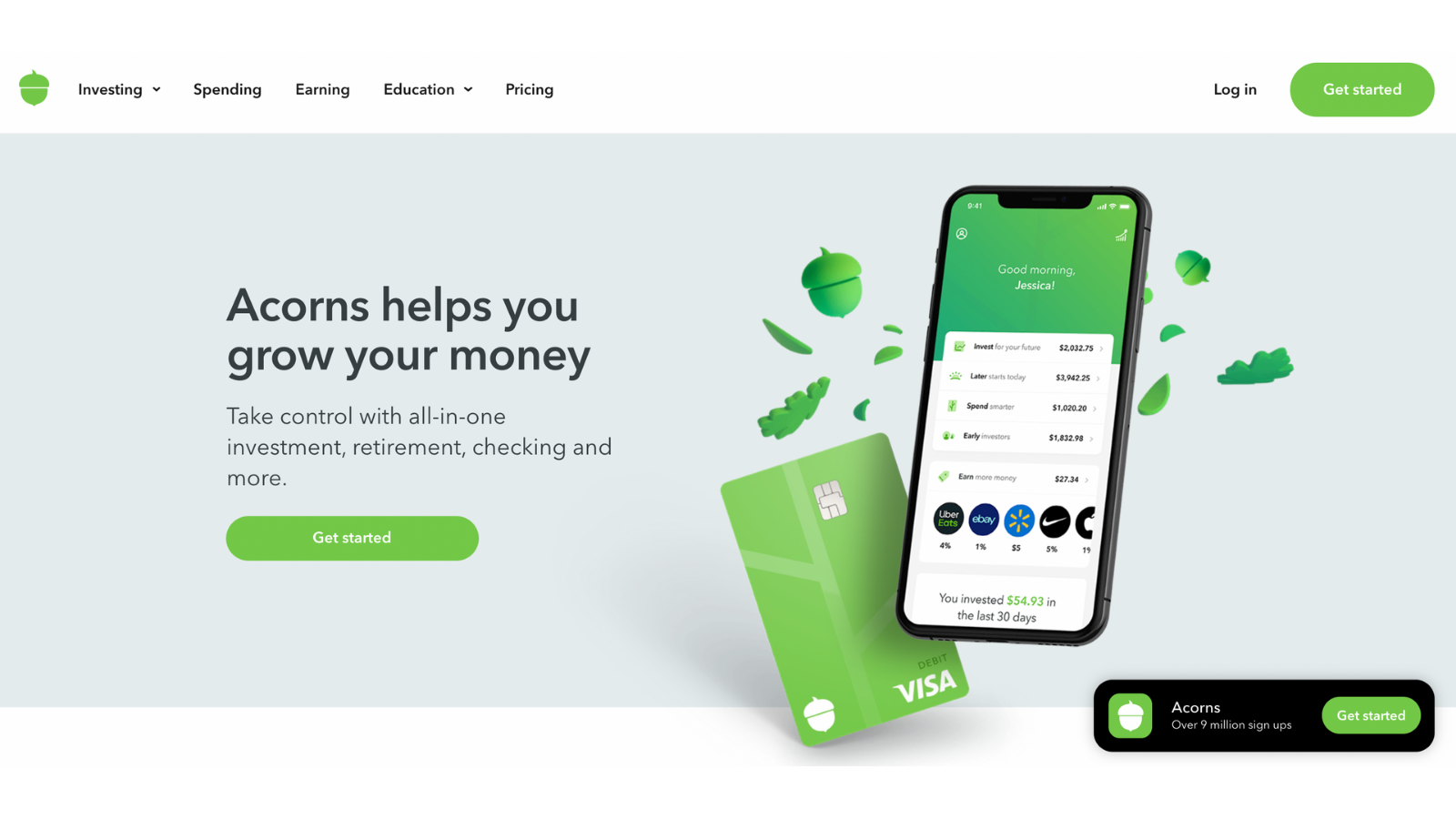

Money Saving App #5: Acorns

Our next top money saving app is Acorns. This app can help you save some serious cash each month. That sounds good right?

Every time you make a purchase, the acorn app will round that to the nearest dollar and add the difference to your Acorn investment account.

This account is used to invest money to fit your financial goals. Essentially, you make money on all your Acorn investments.

The investment accounts for the app are also low cost. You can pay a dollar a month to $5 monthly, depending on the features you want.

You can even add investment accounts for your kids. The only downside is that the return on your investments are not guaranteed. However, it is still worth considering.

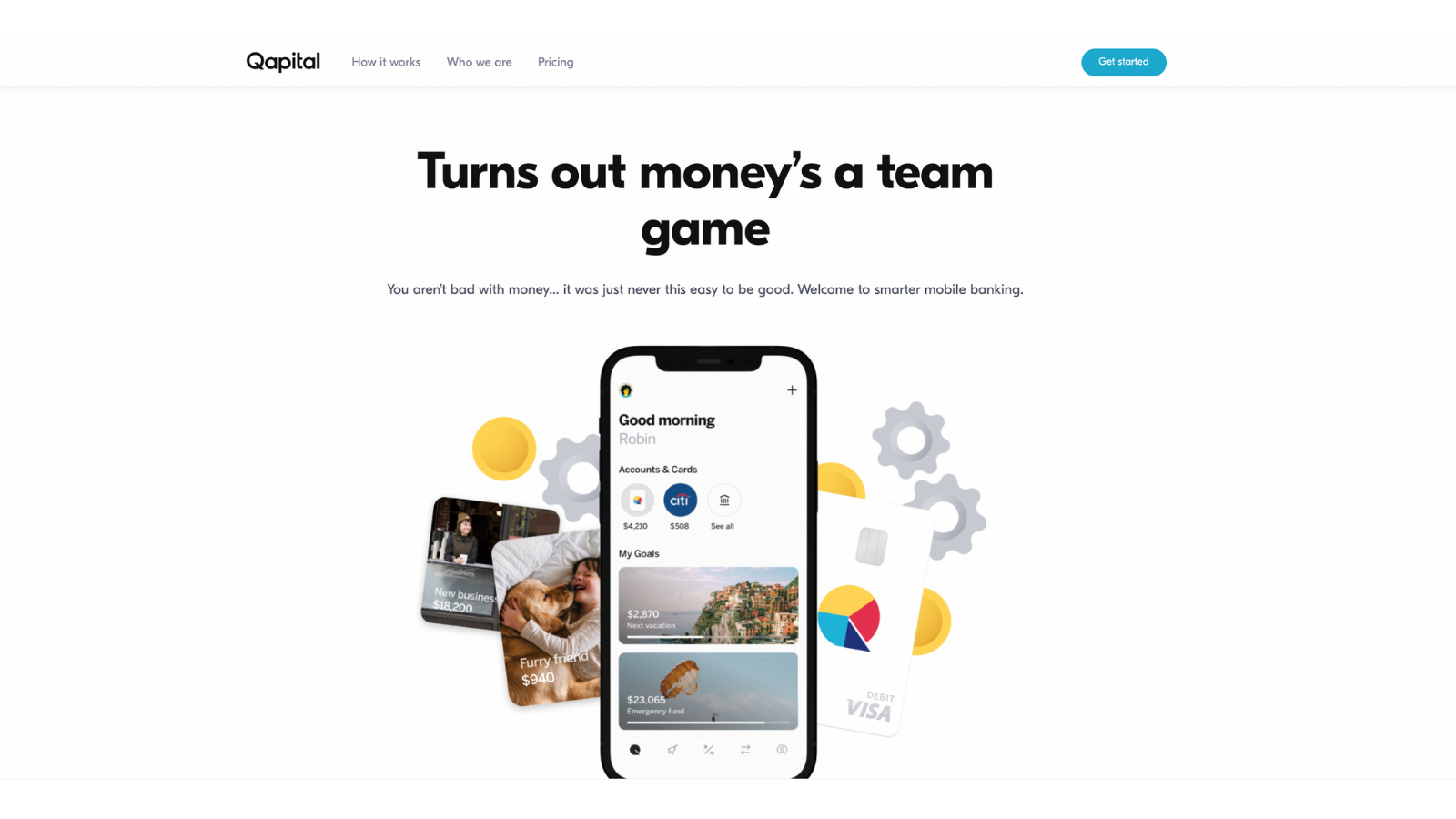

Money Saving App #6: Qapital

Qapital is a money saving app all about goal setting and automating savings. Definitely an app that can help you and your family maximize savings in 2021.

For instance, when you spend money, the Qapital app will round up to the nearest dollar and transfer the difference to a savings account.

You can also contribute money to your Qapital account. The account is a high-yield savings account with 0.10 percent interest earned.

The cost of membership is a bit more than the above apps. Depending on the features, you can be a paid member for $3 a month, and up to $12 monthly.

Is A Money Saving App Right For You?

A ton of people use apps to save money, manage accounts, and invest. Kids and teens too, via the Treasure Card app and debit card.

If you want to save money this year, but find saving challenging, a money saving app may just be the right tool for your financial goals.

And it is all about good financial and spending habits. Savings apps can help you create good savings habits. And you can automate saving, which is even easier.

Make The Rest Of This Year All About Saving Money

Understanding how to save money doesn’t need to be difficult. Anyone can set up savings goals that will boost that savings account balance.

Using technology via the above top money saving apps can prove valuable. Most of us have smartphones at the ready. Use an app on that mobile device to help you save.

Just $500 in your savings account can help you cover unexpected expenses. Having more is ideal. Many financial experts say you need three months of income saved.

Are you maximizing your savings each month? The time to start is now. One of the above apps may help. Happy saving.